Your FICO score or CREDIT SCORE as it is commonly called is a 3-digit number – Arguably the single most influential number in your life and it was designed to convey to lenders the kind of financial risk they would be taking on by having you as a customer. In other words are you a good risk and do they want to lend you money or not?

The credit scoring system by which mostcredit bureaus determine your creditworthiness is the Fair, Isaac and Company(FICO)risk model. It’s a complicated system that uses a mathematicalalgorithm which takes into account many different variables to determine your scores. Based on your scores a lender will determine if it makes sense to lend you money and at what rate will they lend to you.

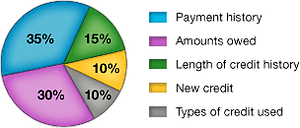

Although the exact formula used seems to be enigmatic and protected by the FTC,the data is grouped into 5 main categoriesthat make up your credit score as outlined below. Each category represents a different level of importance. A score takes into account all of these categories; no one piece of information or factor alone will determine your score.

The percentages in the chart reflect how important each of the categories is in determining your FICO score. For example:

- Do you pay your bills on time?

- How much debt do you have?

- How long have you had your accounts?

- Have you ever defaulted on loan agreements in the past?

Payment History – 35% of your score is based on this category.

The first thing any lender would want to know is whether or not you have paid past credit accounts on time. This is one of the most important factors in a credit score. Having a few late payments will definitely have a sizeable negative impact (at least 30 points) on your scores but that doesn’t necessarily mean that they will prevent you from getting a loan or obtaining credit. It may however be a factor as to the rate at which the lender is willing to lend you money. And that in the long run can be costly. Overall decent credit history will outweigh one or two late payments. But on the flip side of things, having no late payments on your credit report does not equal a perfect score. You may have no late payment and still have a low credit scores as your payment history is just one piece of import information used in calculating your score.

Amounts Owed – 30% of your score is based on this category

Having credit accounts and owing money on them does not mean you are high risk borrower, in fact having credit accounts and making your payments on time each month actually helps your scores! However when someone owes a great deal of money on many accounts, or your credit cards are maxed out or close to it, that can indicate that a person is overextended and is more likely to make some payments late or not at all. Part of the science of scoring is determining how much is too much for a given profile. As a rule of thumb you should ideally keep your credit card balances at 30% or below each card limit as this will help to maximize your overall scores. But again this is just one piece of the puzzle.

Length of Credit History -15% of your score is based on this category

What exactly does credit history mean and why does length matter?Credit history is an overall documentation of your past and current debts, payment history and public records. Simply put, the length of your credit history is how long you’ve been using credit. The length of your credit history begins when you open your first credit card or take out your first loan. Your credit history will grow with age and as you open new accounts. In general, a longer the credit history the higher your scores.That is providing you have been making your payments on time for the most part and that you have a minimum of 3 accounts in good standing. If you have just one or two accounts in good standing, well, that’s a start but it will not be enough to get your scores to their optimum level. Your score takes into account both the age of your oldest account and the overall average age of all your accounts.What is the average age of accounts you ask? This is a simple calculation: divide the ages of your oldest and newest accounts by your total number of accounts. If you only have one credit account, your length of credit history and average credit age are the same.

New Credit – 10% of your score is based this category.

In this day and age of our digital world, people tend to have more credit today than ever before. One of the reasons for that is the ease of which you can apply for credit cards and loans via the internet. However, research shows that opening several credit accounts in a short period of time does represent greater risk, especially for people who do not have a long-established credit history. Your FICO Scores take into account how many new accounts you have by type of account (revolving credit cards or installment loans) and they may also look at how many of your accounts are new accounts. It’s not a good idea to open too many accounts too quickly, especially if you’ve been managing credit for a short time. Each time you apply for new credit whether you are approved or not you will acquire a credit “Inquiry” which will in turn impact your scores on average about 3-5 points. Auto inquiries and mortgage inquires have a much larger impact. New accounts will lower your average account age, which will also have a larger effect on your FICO Scores if you don’t have a lot of other positive credit information. Even if you have used credit for a long time, opening a new account can still lower your FICO Scores.

Types of Credit in Use – 10% of your score is based on this category.

While having a good mix of credit accounts and paying them off as agreed is attractive to a lender and can be beneficial to your credit scores it is not the most important key factor in determining your FICOscore. A good mix of credit will include primary credit cards, retail accounts, installment loans, and finance company accounts. It is not necessary to have one of each, and it is not a good idea to open accounts you do not intend to use. But overall a lender may consider you less of a risk because you have demonstrated the ability to successfully manage different types of credit and the payment systems associated with them.