What is Credit?

Credit is money lent to you by a lender or creditor on the condition that you will pay it back at a later date. The terms and conditions for receiving the credit vary by credit type and lender. Simply put, credit is borrowed money that you can use to purchase goods and services when you need them with the agreement to pay the lender or creditor back at an agreed upon time.

Why Credit Matters

Like it or not, credit is a necessary evil and your credit affects every aspect of your financial life.

Obtaining and sustaining good credit or repairing less than perfect credit is one of the most important financial decisions you can make. It’s a decision that is either going to cost you money or save you money in the long run! Either way, that cost or savings is “significant”

On average, consumers with less than perfect credit will end up paying 30%-40% more per month in higher interest rates if indeed you are able to get financed at all. In the long run this can cost you tens of thousands of dollars or even hundreds of thousands of dollars over the term of a 30 year mortgage. Also, it’s important to understand that poor credit may hinder future employment opportunities as well as your ability to rent an apartment, purchase a vehicle, obtain a credit card, qualify for insurance etc…

How does a lender determine whether or not to lend you money?

Whether or not a creditor decides to extend you credit and the rate of interest at which you borrow, is determined by a number of factors including your current financial obligations and monthly expense obligations as well as your credit history and FICO Scores.

What is your Fico Score?

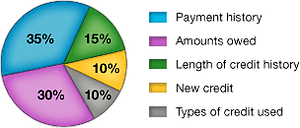

Your credit score or FICO score as it is commonly called is a number – arguably the single most influential number in your life and it was designed to convey to lenders the kind of financial risk they would be taking by having you as a customer. Your score is generated by credit analyzing software that takes into account a number of different criteria. For example, do you pay your bills on time? How much debt do you have? How long have you had your accounts? Have you ever defaulted on loan agreements in the past? The process is complicated, however it does provide the lender a way to determine whether lending you money right now is really a smart move and if so, at what cost? The chart below will help you to have a better understanding of how your score is determined.

What does your Fico Score consist of?

FICO Scores are calculated from a lot of different credit data in your credit report. This data can be grouped into five categories as outlined below. The percentages in the chart reflect how important each of the categories is in determining your FICO score.

These percentages are based on the importance of the five categories for the general population. For particular groups – for example, people who have not been using credit long – the importance of these categories may be somewhat different.

What is a good FICO® score?

Excellent = 800 and higher

With scores in this range your credit or loan applications should always be approved. In addition you should receive the lowest possible interest rates

Very Good = 700-799

A great range to be in. You most likely will be approved for any type of credit or loan and you should be able to take advantage of good interest rates.

Good = 680-699

With scores in this range you should typically be able to get approved but your interest rate will not be at the lowest rate, however they will still be in a reasonable range.

Fair = 620-679

Depending on the type of loan and your credit history you may find the rates you are quoted are not the best therefore costing you extra money in the long run. If you are approved, certain restrictions will apply to the loan’s terms.

Poor =580-619

With scores in this range the chances of approval are low however that does not mean you won’t get approved. It does however mean that if you are approved the terms and interest rates will not be pretty. You will end up paying a whole lot more over a longer period of time.

Very poor = 500-579

If you are able to get a loan at all, your terms and interest rates will be through the roof costing you a ton of money in the long run. You need help, contact us now and let us assist you in improving your credit so that you may qualify for an acceptable loan.

Bad = 499 and lower

You need serious professional help with your credit situation. If you do not get your situation under control things will only get worse. Contact us and let us assist you in getting your credit back on track.

What are the Benefits of Good Credit?

Simply put, a good credit scores can save tens of thousands dollars over the life of your loan or even hundreds of thousands of dollars over the life of a 30 year mortgage.

A healthy credit score of 700 or above can help you qualify for low interest rates on home loans, car loans and credit cards. If you are considered to have a good or excellent credit rating then you will benefit in the following ways:

- Quick credit approval

- Lower interest rates

- Refinance current loans for lower interest rates

- Get better credit card, auto loan, and mortgage offers

- Better employment and promotion opportunities

- Better insurance rates

- Rental approval

- Reduced deposits for utilities

What is the Cost of Bad Credit?

As mentioned above, the average American with less than perfect credit spends an extra 30%-40% a month in higher interest rates. Don’t allow your less-than-perfect credit keep you from reaching your financial goals. We can help you restore you credit back to good standing.

.Here are just a few aspects of your financial life that are affected by your credit:

Employment Opportunities:

Employers in today’s market investigate your dependability along with your track record of responsibility based off of your credit. Employers look to see how you manage your personal finances and see whether they can entrust their finances with you as an employee.

Renting Instead of Owning:

The “American dream” is to own a home, but more importantly than having something to call your own is the financial repercussion of renting instead of owning an appreciating asset. The money that you are spending each year in rent could be going into your pocket instead of your landlords.

Higher Mortgage Interest Rates

This one can be a killer! If your home is currently financed at a higher than average interest rate (based on the current market) then the end result of this is that the loan on your home over a 30 year period can end up costing you tens of thousands orhundreds of thousands of dollars more over the lifetime of that loan! To most people, the difference in someone with great credit being financed at 2.75% verses someone with fair credit being financed at 4.3% does not seems like a big difference but trust me when I say that can cost you or save you tens of thousands to hundreds of thousands over the lifetime of the loan depending on the size of the loan. I am sure you’ll agree that kind of money can be much better invested or spent on many things other than interest.

Automobile Financing:

If you are financing a car and have bad credit, you are probably paying thousands of dollars more than you would pay once you had restored your credit. This extra interest shows up every month in a dramatically higher payment. One of the first things that our members often do once they have restored their credit is to refinance their automobile for a fraction of their current payment or buy twice the car at nearly the same payment.

How to obtain new credit or repair existing credit

You obtain “credit” by applying for it from a credit grantor, whom you agree to pay back the amount you’ve borrowed, plus applicable finances charges and interest over an agreed upon amount of time.

For many people just starting out, they may need to begin their credit building process by obtaining either secured or unsecured cards and loans. At Insight Credit Group Inc we walk our clients through a step by step building process.

If you are one of millions of Americans whose credit has been negatively impacted due to our recent economy we can help! We are experts at both removing inaccurate and derogatory information from your credit reports as well as helping you re-build new credit

How to sustain good credit

Once you have obtained credit it is important that you do everything possible to keep your credit in good standing. Below are a few tips that will ensure good credit history.

Pay your bills on time each month – The largest factor that lenders take into account when determining whether or not to extend you credit is your “payment history” this is based on your ability to make your payments on time each month. If possible pay more than the minimum amount.

Continue to build “Payment History – Depending on the lender and they type of credit or loan you are applying for, most lenders today want to see a minimum of 6-12 “consecutive” months of good payment history before they will even consider extending you credit. So ideally you will need to continue to make your monthly payments on time for at least 6 – 12 months. Understand that the longer you have an account in good standing with current monthly activity the better for your scores.

Keep your balances under 30% of your credit limit on each credit card – Once you have charged more than 30% of your credit limit on any given credit card, your FICO scores will begin to be negatively impacted. The closer you get to maxing out a card, the bigger the hit to your credit scores. So for example, if the credit limit on your card $1000 then ideally you should keep your balance under $300 monthly.

Avoid carrying a balance each month if interest rates are high –If the credit card that you have has a high interest rate then it is best to pay it off in full each month rather than carrying a balance. These high interest rates can add up quickly and you will soon realize the if all you are making each month is your monthly minimum payment than all but a few dollars is going towards interest rather than principal. The end result is that you end up paying out money each month yet you don’t make much of a dent in your principal so now you are in this vicious cycle and on your way to getting yourself in debt over your head. My advice would be to charge no more than you know you can pay off each month.

Do not close your accounts – Many consumers make the mistake of closing out accounts thinking that this will help helptheir scores, when in reality, it s just the opposite effect.

However, your FICO score takes into consideration something called a “credit utilization ratio”. This ratio basically looks at your total used credit in relation to your total available credit; the higher this ratio is, the more it can negatively affect your FICO score. So, by closing an old or unused card, you are essentially wiping away some of your available credit and there by increasing your credit utilization ratio.

THINGS YOU SHOULD KNOW ABOUT YOUR CREDIT REPORT

Mistakes do happen…..

Mistakes on your credit report are more common than you think; research conducted by US Public Information Research Group US PIRG, Washington, D.C. and the FTC found:

SEVENTY PERCENT (70%) of credit reports overall contain errors or Mistakes.

TWENTY-NINE PERCENT (29%) of credit reports contain serious errors, false delinquencies, or accounts that did not belong to the consumer.

FORTY-ONE PERCENT (41%) of credit reports contain demographic information that was misspelled, outdated or incorrect.

TWENTY PERCENT (20%) of credit reports were missing major credit, loan, mortgage or other information to demonstrate the credit worthiness of the consumer.

TWENTY-SIX PERCENT (26%) of credit reports contain accounts that were closed by the consumer but incorrectly listed as open (or) “closed by credit granter”.